Curious about the current markets?

Before making any trading decisions, it's crucial to understand the existing market conditions and trends.

Trading indices enable traders to mitigate unnecessary risks by investing in a diverse array of assets rather than focusing on a single company or sector. Additionally, a stock index serves as a trustworthy indicator of market sentiment (bullish or bearish). Since it comprises shares from major global companies, any market movements are quickly reflected in the index's value, representing the average price of the entire group.

Advantages of index trading: Traders with limited capital can access the market; it's more convenient to purchase multiple shares at once rather than individually analyzing company stocks; it provides immediate portfolio diversification.

Disadvantages of index trading: Like all investments, it carries risks; you cannot add or remove stocks from the index; it typically yields smaller profits compared to trading higher-risk assets.

Numerous indices are available today, with some prominent ones being:

- NASDAQ consists of 100 US technology-related companies (excluding financial firms) such as Adobe, Cisco, Apple, Tesla, and Microsoft.

- S&P 500 comprises stocks from 500 US companies, including General Motors, J.P. Morgan, Starbucks, Twitter, and Visa.

- JPN 225 is based on the stock prices of 225 Japanese companies, including Yamaha, Konica, Nikon, and Kawasaki.

- GER 30, the German index established on July 1, 1988, includes companies like Bayer, BMW, and Henkel.

- The Dow Jones, the first stock index created in May 1896, originally included 12 major US companies and now comprises 30 significant US companies.

Most indices are based on companies from specific regions. For instance, the S&P 500 includes US companies, the FTSE 100 includes UK companies, and the CAC 40 includes French companies, serving as indicators of their respective economies.

Some indices focus on particular industries (e.g., Keefe's banking index, FTSE 35 mining index), allowing traders to assess the overall prospects of these sectors. Stock market indices aggregate large amounts of data, which are invaluable for other market participants.

Significant market downturns include the 2000 dot-com bubble (tech stocks fell significantly), the 2008 global financial crisis (collapse of the US banking sector and financial system), and the 2020 Coronavirus pandemic (oil market downturn).

These recessionary periods underscore the importance of effective risk management for traders.

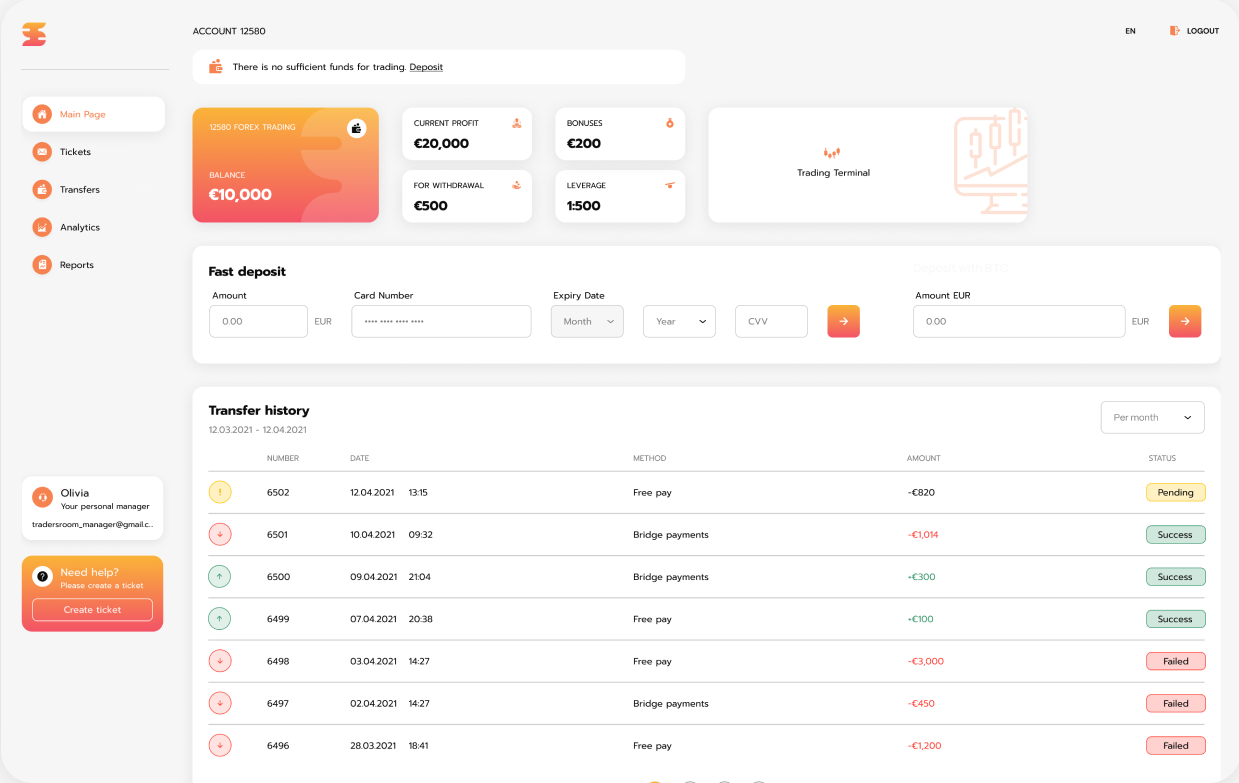

Our platform offers numerous features to assist traders in making profitable transactions. These include easy registration, fixed spreads between buy and sell prices, real-time charts, leverage options, analytical reports, and around-the-clock customer support.

Register now to unlock a world of diverse investment opportunities.